Your Partner for reliable greenfuel brokerage

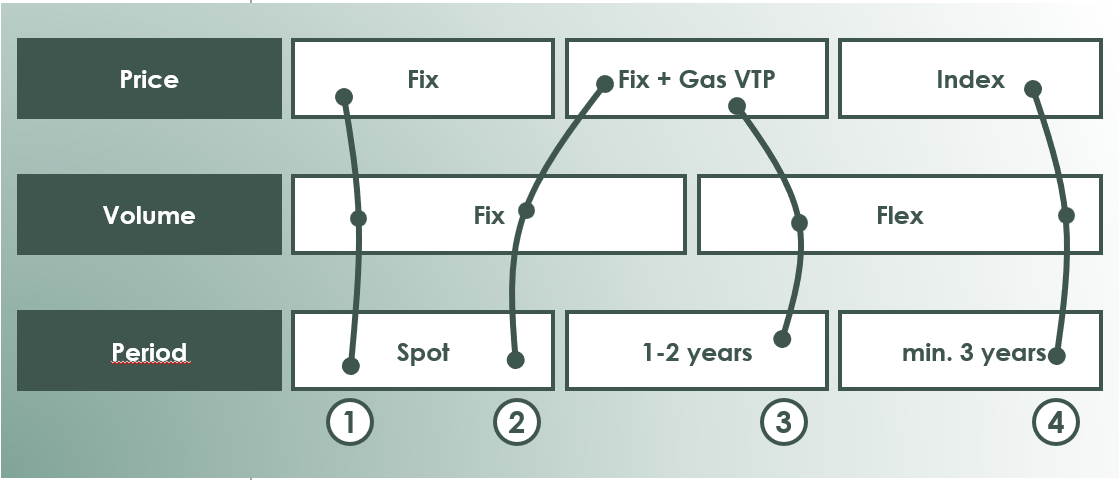

The biomethane market features a wide variety of commercial contracts. The following section describes the most common sales and purchasing strategies. These range from classic spot trading and flexible volume deliveries to long-term purchase agreements and corresponding indexing of the trading price, e.g., to a publicly traded value.

Transaction 1:

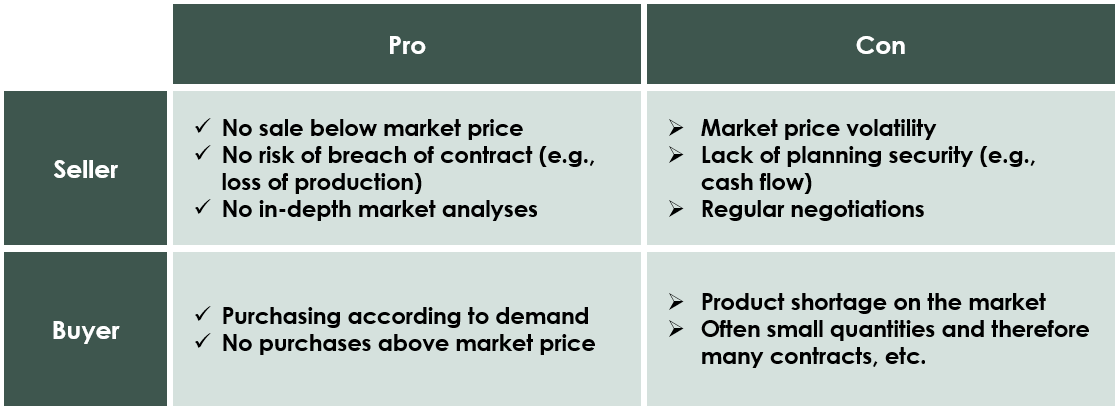

Transaction 1 (see figure above) is characterized by a fixed agreed price and a fixed agreed volume. The biomethane is produced and is usually transferred immediately after the contract is signed, either on an agreed gas delivery date or as a multi-day band delivery. The trading transaction is completed when the certificates are transferred and payment is made by the buyer.

Transaction 2:

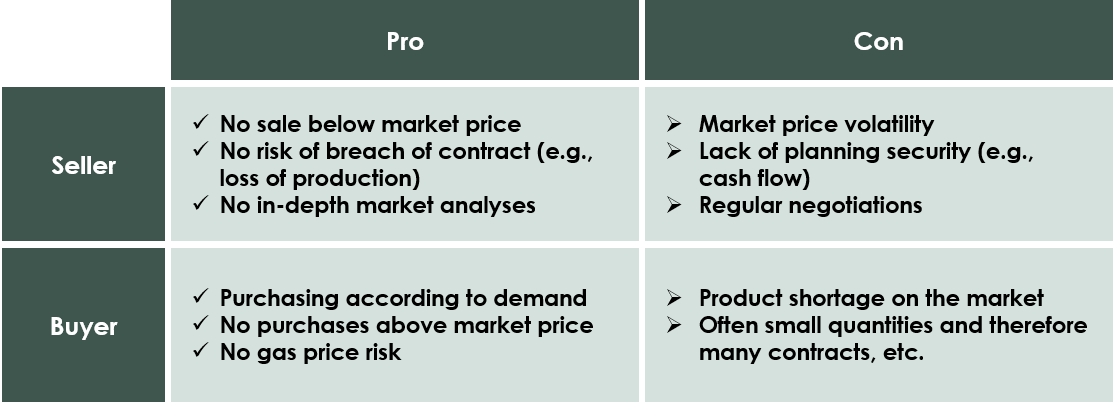

Transaction 2 differs only slightly from the first transaction, but is also increasingly used on the market. A defined volume is sold spot. The price for the green share of biomethane is agreed as a fixed price, whereas the price for the physical molecule is contractually fixed depending on the price of natural gas. Normally, a listed index is used for this purpose, which is then used to calculate the price when the gas is transferred.

Transaction 3:

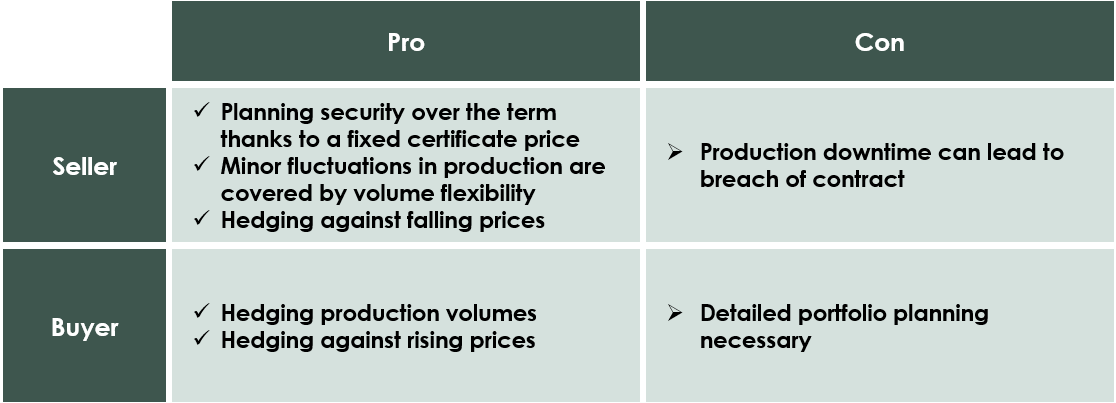

Like the second transaction, the third example is also characterized by a fixed green gas component and an indexed fossil gas component. The volume, on the other hand, offers volume flexibility, which is often negotiated at 10 to 20% in order to give the producer a certain degree of security against production fluctuations. Terms of one year or more are the norm and are often concluded with volume flexibility.

Transaction 4:

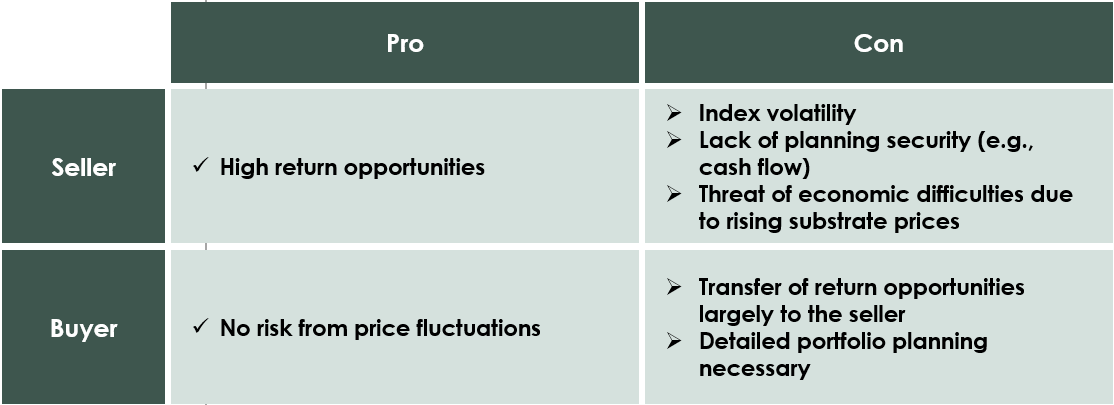

Transaction 4 is characterized by a long-term and flexible contract. Both the green share of the biomethane and the fossil share are priced based on a market index. In the German fuel sector, this can be the THG quota, which is published by certain market participants at defined intervals. The seller receives a percentage of the THG quota revenue instead of a fixed sales price for the biomethane supplied and thus has corresponding return opportunities and loss risks. However, upper and lower price limits can also be set in detail to reduce risks.

In addition to the examples mentioned, there are other solutions in sales as well as details that are coordinated and defined on a case-by-case basis depending on the transaction.

Are you interested in further information on this topic? Please feel free to contact us. We look forward to talking to you!

Contact us to download the publication

greenfuelpartners GmbH

Tal 44

80331 Munich

Germany

Phone: +49 89 2096 9097

Mail: info@greenfuelpartners.com