Your Partner for reliable greenfuel brokerage

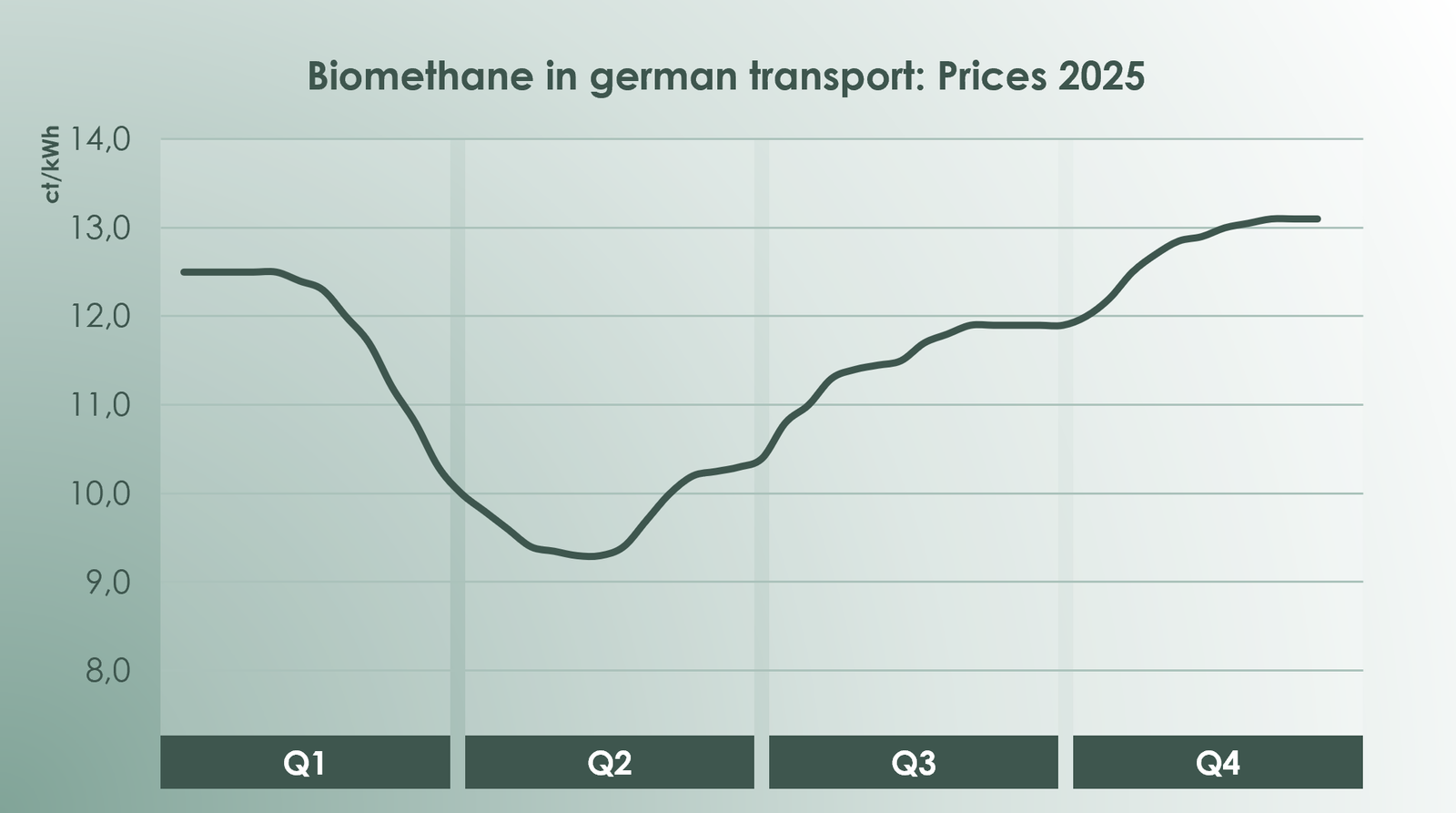

The biomethane industry in the THG quota market can look back on another turbulent year. After a massive drop in prices in the spring, despite the already relatively low price level beforehand, prices rose again over the summer months and especially in the fall. The current price of 13 ct/kWh at the end of the year has calmed the mood among producers somewhat, but the real fun has yet to begin.

Basis for the prices quoted:

Q1, 2025

In the first quarter of 2025, biomethane prices remain at a moderate level of around 12.5 ct/kWh due to the remaining effects of annual contracts from 2024. Nevertheless, the first downward trends are quickly becoming apparent. Increased uncertainty arises due to growing suspicions about dubious quantities of biodiesel imports on the market, which are creating the first signs of price pressure. By the end of February at the latest, it becomes apparent that the THG quota in the transport sector is under unusually strong pressure. This has a direct impact on the willingness to pay for advanced manure biomethane from German production. With prices around 10 ct/kWh and noticeable uncertainty in the market, the second quarter begins.

Q2, 2025

The price downtrend continues in the second quarter, reaching a low of roughly 9.5 ct/kWh. Systematic multiple certifications, large quantities of HVO and FAME that have been incorrectly certified as waste-based, and inadequate control mechanisms lead to oversupply and a loss of trust in the market. With initial political review and the expectation of further measures, quota-obligated companies are stopping large imports. In contrast, demand for high-quality and reliable biomethane from Germany is rising. In addition, it is not possible for producers to produce on a sustainable basis at such prices. Those who do not have to sell due to a full balance group or operating costs are therefore not considering doing so.

Q3, 2025

The two developments from the second quarter are leading to further price increases in Q3. Many producers are holding off on sales due to the upward price spiral and are betting on further price increases in order to at least cover their production costs. A sale price of around 12 ct/kWh is establishing itself as a rough reference value and is now being requested more and more frequently over the summer months. At the same time, THG quota prices continue to develop positively, breaking the EUR 300/t level for advanced certificates. As the benchmark is reached, trading activity increases, driven by producers' willingness to sell. The market price remains stable at this level for several weeks.

Q4, 2025

Speculation surrounding the adoption of the draft legislation on the implementation of RED III into national law is gathering pace. In addition, discussions are likely to focus on issues such as postponing the elimination of double counting within the THG quota until 2027. At the same time, THG quota prices are rising to over EUR 400/t in the fourth quarter. The main driver is expensive HVO. As a result, biomethane prices are rising sharply again, particularly in October, reaching 13 ct/kWh. Trading activity on the producer side is increasing at this level in the year-end rush.

Outlook, 2026

No market participant can provide a reliable forecast for future price trends for biomethane in the German THG sector. Nevertheless, there is a certain consensus regarding further price increases in 2026. However, it is also clear that biomethane prices do not correlate linearly with THG quota prices. The bottleneck for gas-powered vehicles remains, even though BioLNG is gaining momentum in heavy-duty transport. Large price increases, as hoped for by some market participants, are therefore rather unrealistic for the time being, but this should not diminish the current cautious optimism. In addition, further sales markets such as the maritime sector could open up in the near future, reaching the price level of the German THG market and thus boosting demand.

The prices quoted in this article are for informational purposes only; liability for completeness, accuracy, or any resulting damages is expressly excluded.

Are you interested in further information on this topic? Please feel free to contact us. We look forward to talking to you!

Contact us to download the publication

greenfuelpartners GmbH

Tal 44

80331 Munich

Germany

Phone: +49 89 2096 9097

Mail: info@greenfuelpartners.com